Roth ira contribution calculator 2021

3 In 2021. Limits could be lower based on your income.

Download Roth Ira Calculator Excel Template Exceldatapro

See Roth IRA contribution limits.

. The annual contribution limit to an IRA is 6000 in 2022 though this figure usually rises every few years. Single filers have to make less than 129000 in 2022 up from 125000 in 2021 to make a full contribution to a Roth IRA. If you earn 2000 then your maximum IRA contribution for the year is 2000.

Your employer may also match contributions up to a certain percentage of your annual income. Those who are married but filing separately can only make a reduced contribution if their incomes are less than 10000. Roth IRAs have the same annual contribution limits as traditional IRAs for 2021 and 2022.

Roth IRAs have the same contribution limits as traditional IRAs which is the below for 2021. Thats a lot of money. Get a Roth IRA Calculator branded for your website.

0 IRA Annual Fee. What are the eligibility requirements to open a Roth IRA. For the 10 years ending December 31 st 2021 had an annual compounded rate of return of 136 including reinvestment of dividends.

The IRA contribution limit is also adjusted by the age of the taxpayer. Get details on IRA contribution limits deadlines. ROTH IRA For the 2021 tax year.

Benefits of Contributing to Both a 401k and Roth IRA. However it does have some IRA fees that the other two brokerage houses dont have like a 25 fee for a. 0 ETrade Services ETrade does not charge a fee to close an IRA.

You can contribute 6000 for the tax year 2021 and 6000 for the tax year 2022 7000 for tax year 2021 and 7000 for year 2022 if you are at least age 50 or up to 100 of earned income whichever is less. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. What are the contribution limits.

This limit applies across all IRAs. This is known as the catch-up contribution limit and applies to savers age 50 and older. 198000 for married filing jointly.

The lower of 6000 or your taxable compensation. Roth IRA calculator. Roth IRA Contribution Limits for 2021 and 2022.

For those who are married and filing jointly the amount is increased to an adjusted gross income of. If youre under age 50 you can contribute up to 6000. This calculator assumes that you make your contribution at the beginning of each year.

6000 under age 50. Know the Rules. Assuming you are allowed to make the maximum contribution and earn more than 60000 per year.

6000 the maximum IRA contribution for 2021 Ex. Contributing to both a 401k and Roth IRA allows you to maximize your retirement savings and benefit from tax advantages. 2021 and 2022 Contribution Limits.

In 2022 you can invest up to 20500 a year in a 401k 403b or in most 457b plansnot including the employer match. For 2021 and 2022 6000 per year 7000 per year. To the maximum amount if your gross income is less than 129000 for single filers and 204000 for married couples.

The maximum amount increases to 7000 up to taxable compensation if both of these apply. You may contribute simultaneously to a Traditional IRA and a Roth IRA subject to eligibility as long as the total contributed to all Traditional andor Roth IRAs totals no more than 6000 7000 for those age 50 and over for tax year 2021 and no more than 6000 7000 for those age 50 and over for tax year 2022. There is an exception.

You should also note that the contribution deadline for IRA limits when. Up from 140000 in 2021 for those filing as single or head-of-household. This condition is satisfied if five years have passed since you first made a contribution to any Roth IRA not necessarily the one you plan to tap.

If you are a single or joint filer your maximum contribution starts to reduce at 125000 and 198000 for tax year 2021 and 129000 and 204000 for tax year 2022 respectively. A Roth IRA and a 401k are two types of retirement accounts with one big difference in how they are taxed. IRA Contribution Deadlines for 2022 and 2023.

0 IRA Termination Fee. When Not to Open a Roth IRA. For a Traditional IRA you can contribute up to 6000 for the tax year 2021 and 6000 for the tax year 2022 or up to 100 of earned income whichever is less.

Older taxpayers can invest more in their retirement accounts. If youre age 50 or older you can contribute up to 7000. Total annual contributions to your traditional and Roth IRAs combined cannot exceed.

A Roth IRA is a retirement account that lets your investments grow tax-free. There are income limitations to open a Roth IRA account. Those under age 50.

Traditional IRA Roth IRA OneStop Rollover IRA Simple IRA SEP IRA Beneficiary IRA Complete IRA and Minor IRA IRA Setup Fee. Your filing status is single head of household or married filing separately and you didnt live with your spouse at any time in 2021 and your modified AGI is at least 125000. Your eligibility to open a Roth IRA and how much you can contribute is determined by your Modified Adjusted Gross Income MAGI.

There are specific IRS income limits for contributions to a Roth IRA. For example in 2021 the upper limits are. Those over age 50 can contribute an additional 1000 each.

2022 traditional Roth IRA contribution limits. And what you expect your annual return to be. You can use our investment calculator to customize those details for your own financial.

You cant make a Roth IRA contribution if your modified AGI is 208000 or more. For 2021 the amount you can contribute begins to phase down when your annual income hits 125000 for single filers and 198000 for married-filing-jointly filers. You cant make a Roth IRA contribution if your modified AGI is 140000 or more.

The maximum allowable contribution to a Roth IRA in 2022 is just 6000 for those below the age of 50. 7000 age 50 or older. Our Roth IRA calculator.

Take money out of an IRA See why age matters for withdrawals. Total contribution limit to both Roth and traditional IRAs of up to 6000. The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older.

Roth and Traditional IRA Contribution Limits for 2021 and 2022. Aug 18 2021. With a 401k account youll contribute money you havent yet paid taxes on.

To better understand your eligibility use our IRA Contribution Calculator.

Roth Conversion Q A Fidelity

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Historical Roth Ira Contribution Limits Since The Beginning

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

What Is The Best Roth Ira Calculator District Capital Management

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Historical Roth Ira Contribution Limits Since The Beginning

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Excel Template For Free

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

What Is The Best Roth Ira Calculator District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Roth Ira Calculator How Much Could My Roth Ira Be Worth

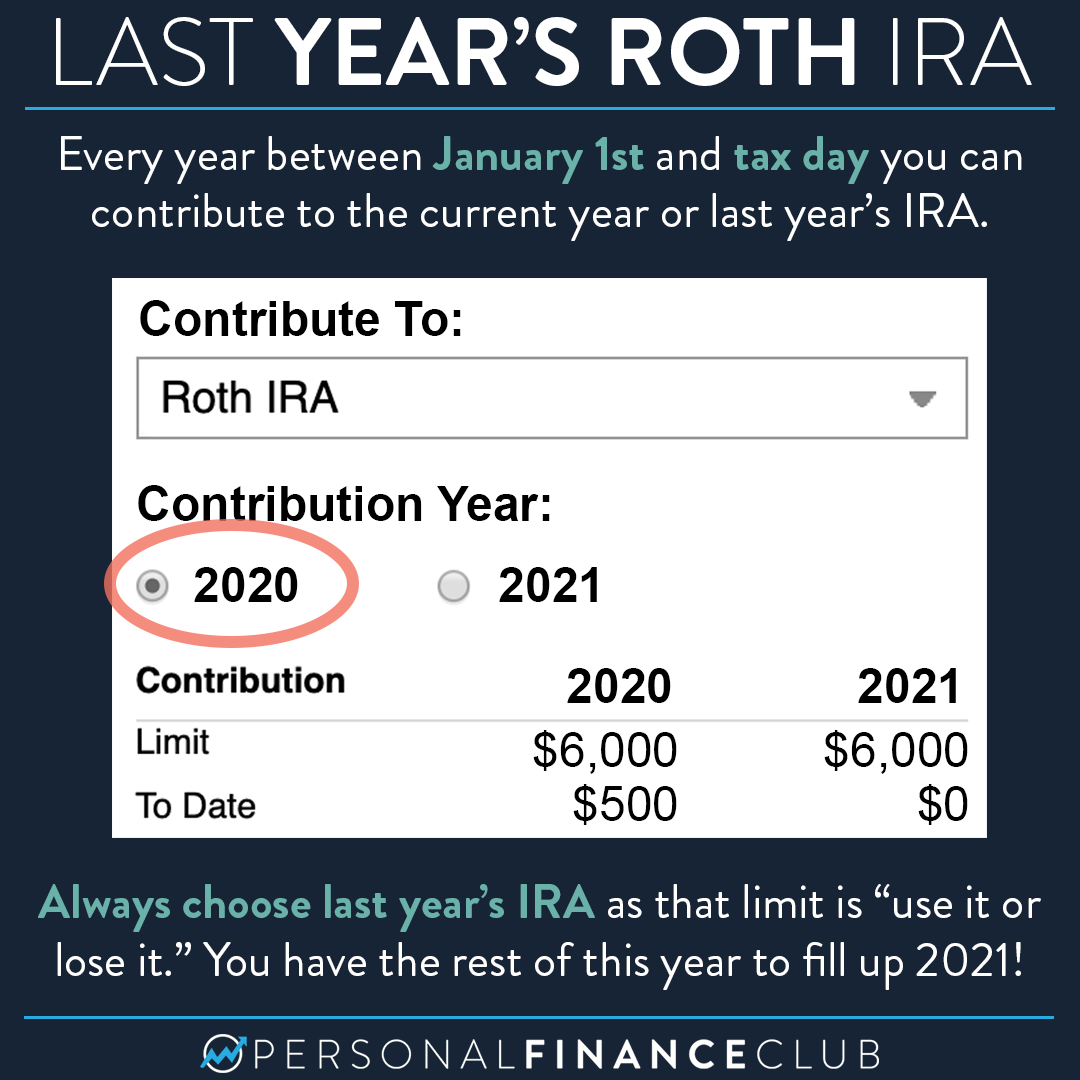

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club

Contributing To Your Ira Start Early Know Your Limits Fidelity